Investing with Exchange Traded Funds (ETFs) for the Individual Investor

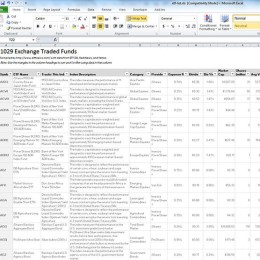

1500+ Exchange Traded Funds (ETFs) (4)

There's a lot of information out there, but it's scattered on multiple web pages and sites. Sometimes is just easier to sort, filter, and group data using Excel. So I …

Exchange traded funds (ETFs) are powerful tools for assembling diversified portfolios. What's more, they are available for use by investors both large and small. This site is geared towards discussing the needs of the individual investor. The following paragraphs highlight articles I think are key to learning about exchange traded funds as well as investing in general.

Before diving in, you'll want to first get a high-level understanding of what is an ETF. There's also a bit more information about the difference between closed-end funds (CEFs) and ETFs and how ETFs are priced. For an even more in-depth look, check out the guide to ETFs which also touches on the common question of ETFs vs mutual funds.

And then, once you know what ETFs are, take a look at the investment strategies that can be applied using ETFs. I tend towards the buy-and-hold philosophy, but several other strategies are discussed as well. I'm pretty much a do-it-yourselfer when it comes to investing my money, but if you're on the fence about it, consider the items discussed in my look at online investing vs. traditional financial planners.

With a basic understanding of ETFs, consider looking into things like ETF timing (not that I recommend it), why active traders fail, and how investment books fail. Although everyone's situation will be different and will require a portfolio with particular characteristics, you may find some good ideas from ETF portfolios assembled by well-established and successful institutional investors.

With an ideal portfolio in hand, you'll need to examine the list of ETFs available to find the ones that you can plug in to achieve your investment goals. It would also be wise to understand the tax implications of different ETFs e.g. do they have high portfolio turnover?

In terms of maintenance, you should familiarize yourself with the ideas behind dollar cost averaging, getting around the IRS' wash-sale rules and rebalancing your portfolio. And since most people would be advised to maintain some sort of cash-based holdings for emergencies and ETF buying opportunities, there are some specific recommendations for where to stash cash for the short-term.

Beyond the specific areas of ETFs and if you're entirely new to the world of investing, be sure to check out the 10 basic principles of investing. I've also got quite a bit of additional content on investing in general. I think of particular interest are the fairly length posts on 401K plans as well as a look at IRAs, Roth IRAs, and Roth 401Ks.

As with all things relating to money, don't take my advice as gospel. Do your own research and question everything you read whether it comes from a web site or from a financial advisor. I wish you luck building and maintaining your investment portfolio!

-

Water ETF: A Precious Commodity Despite Its Abundancy

-

BRIC ETF: Emerging Markets Are Riskier, But Growing Faster

-

Two Brain ETF Portfolio: Rational Investing With Some Fun Mixed In

-

Yale ETF Portfolio: If It's Good Enough For Yale…

-

Can I Be Sued for My IRA?

-

ETF Rebalancing: Keep Your Allocations In Alignment

-

Euro ETF: A Struggling Region May Still Be Worth Your Investment

-

Equal Weight ETFs: Favoring Smaller Cap Holdings Could Be Key

-

Fixed Income ETF: Tap Into the Bond Market

-

ETF Exit Strategy Considerations: When Do You Get Out?

-

Commodities ETF: They're Not Interesting, But Key To Everyday Living

-

Microcap ETF: A Tough Segment To Invest In Now Made Easier

-

Health Care ETF: Does An Aging Population Guarantee a Win?

-

ETF Dollar Cost Averaging

-

ETFs vs. CEFs: Confusion Remains

-

A Better Dividend ETF?

-

Complete Guide to ETFs for Newbies

-

More Commodity ETFs: They'll Keep Coming As Long We Keep Buying

-

What You Should Know About Leveraged and Inverse ETFs

-

Dollar Cost Averaging with ETFs: Taking Emotion Out of the Buying Equation

-

An Index of All Things: Does Investing In Everything Make Sense?

-

Best ETF Articles: Well They Were At One Point

-

Dividend ETF: Diversity With a Focus on Income

-

Alternative Energy ETFs: Eventually We Will Run Out of Oil and Gas

-

Platinum ETF: A Rare Metal Worth Your Investment Dollars?

-

Clever ETF Stock Symbols

-

International ETF: Still Some Diversification Benefits

-

Bond ETF: Safety With Liquidity and Flexibility?

-

Currency ETF: Can You Win At This Zero-Sum Game?

-

International REIT ETF: Finally Foreign REIT ETFs for Individual Investors

-

High-Yield Bond ETF: Take On Risk for Better Returns

-

REIT ETFs: Earning Real Estate Returns Without Having To Mow the Lawn

-

How Does ETF Pricing Work?

-

Gold ETF: Not Much Intrinsic Value, People Sure Do Like It

-

Couch Potato ETF Portfolio: Probably Better Than Constant Tinkering

-

Oil ETF: Will Increasing Consumption Lift These Funds?

-

Biotech ETF: What Could Be Better Than Medicine and Tech Combined?

-

Coffeehouse ETF Portfolio: Boring, But Simple

-

Silver ETF: Investing In a Metal With Actual Uses

-

Energy ETF: Does Continued Growth Around The World Make These a Sure Bet?

-

Russia ETF: Live There? Nope. Invest? Maybe.

-

The Big List of Barclays iShares ETFs

-

Inverse ETF: A Contrarian Exchange Traded Fund

-

Natural Gas ETF: Add A Little Variety To Your Energy Holdings

-

The Case Against Commodity ETFs

-

Technical ETF: If You Believe In the Approach But Want Pros to Execute

-

Barclays' International REIT ETF: Own Property (Sort Of) Around the World

-

Green ETF: Investing in Feel-Good, Eco-Friendly Companies

-

Steel ETF: Growth Means Building and Buildings Require Steel

-

Technology ETF: On-Going Fund Gains From the Never-Ending Tech Cycle?

-

When the Stock Market Tanks (And You Know It Will)

-

Mortgage ETF: Hoping That People Pay Off Their Loans

-

Canada ETF: Invest In This Commodity Heavy Country?

-

Small Cap ETF: Small Companies Are More Likely To Grow In Multiples

-

Treasury ETFs: Are They Really the Safest Exchange Traded Funds?

-

Definition of ETF: Just What Is An ETF?

-

Flaws With the S&P 1500 ETF And Why I'm Not Buying

-

Another Commodity ETF: They Keeping Coming

-

Leveraged ETFs: Bigger Wins, But Also Bigger Losses

-

Emerging Market ETF: Where the Growth Is

-

Getting Around the Wash Sale Rule with ETFs

-

Spin-Off ETF: Banking On The Implied Value of a Spin-Off

-

10 Overly Niche ETFs: They'll Happily Take Your Money

-

ETF Checklist: Don't Get Suckered and Make a Bad Buy

-

1500+ Exchange Traded Funds (ETFs)

-

Nano Tech ETF: Betting Big On Really Small Things