Advantages Of Trading Penny Stocks Over Large Cap Stocks

The stock market universe consists of penny stock companies valued at millions of dollars or less and mega-cap tech giants worth north of $1 trillion. Traders can choose between trading either extreme although getting started with penny stocks trading is the cheaper option and the preferred route for new traders.

Penny Stocks Are Cheaper

There is no uniform definition of what constitutes a penny stock. Many traders agree it includes any stock that trades for $5 per share or less. Other traders take the term literally and define penny stocks as shares that trade below $1 per share.

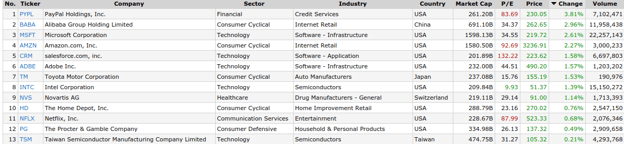

Regardless of which definition someone ascribes to, penny stocks are much cheaper to trade compared to large-cap stocks. Large cap household names like Walt Disney Co, Microsoft, Facebook, Apple, and Netflix all trade above $150 per share.

Buying 100 shares of any of these stocks is certainly out of reach for new traders that are just getting started. Forget about buying even 10 shares of Amazon's stock that trades above $3,000 per share.

But buying 100, 200, or even 500 shares of a penny stock is within reach for most new traders.

Penny Stocks Move Hard And Fast

Traders love penny stocks because of the potential for large moves. There are many penny stocks that gain or lose more than 20% in a given day. Traders can easily identify these fast-movers through a chat room, stock scanner, or even following trustworthy traders on Twitter.

Here is a small sample of penny stocks from today's trading session (Dec. 15) that rewarded penny stock traders with a gain of at least 20%. As a reminder, a trader can profit on a falling stock by taking a short position.

- Mind Technology, Inc (NASDAQ: MIND): Up 50% after falling 28% the day prior.

- Amyris, Inc. (NASDAQ: AMRS): Up 25% after hosting an investor presentation.

- Drive Shack (NYSE: DS): Up 25% ahead of Friday's reopening of its entertainment golf venue.

- Concord Medical Services (NYSE: CCM): Down 44% after soaring around 180% the day prior.

- vTv Therapeutics (NASDAQ: VTVT): Down 25% after announcing disappointing Phase 2 study results.

- Sensus Healthcare (NASDAQ: SRTS): Down 25% on profit-taking after the day prior's 26% move higher.

At the same time on Wednesday, not a single mega-cap stock was higher by more than 4%. A move above 25% is extremely uncommon and even a gain of 10% for a large-cap is rare.

Penny Stock Drawbacks

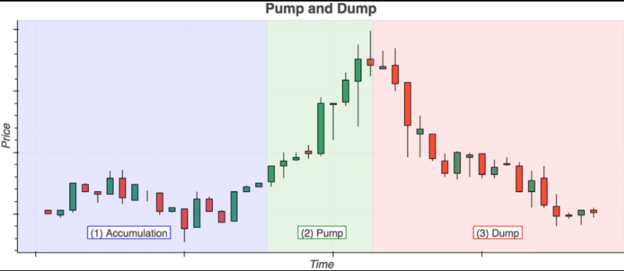

To say that the penny stock universe is void of fraud and manipulation is not truthful. One of the more common frauds taking place is something called pump and dump. In short, a company or large individual investors illicitly contracts stock promoters to “pump” up their shares through manipulative marketing that creates a sense of urgency.

You might have seen one along these lines: “This penny stock can displace Amazon within five years and gain at least 5,000%. Buy the stock now before Wall Street figures out the stock market's current best secret.”

There is a sucker born every minute and many people are likely to fall prey to this scheme. Once enough people buy up the stock and push the price higher, the manipulators will start selling their shares — hence the “dump” part of the name.

However, many penny stock traders have become experts at identifying these pump and dump schemes. They are able to (legally, of course) take the other side of the trade and profit from other people's ignorance.

This type of fraud is non-existent for large-cap stocks. There might be one instance of a major fraud taking place within a large-cap company every year or two. The most recent notable instance was Luckin Coffee, a China-based coffee chain that acknowledged falsifying sales numbers.

Conclusion: Get Started With Just $500

There is no answer as to how much money someone needs to deposit in a broker account to start trading penny stocks. Of course, it is always wise to trade with money you can afford to lose.

Trading with rent money or other funds required for day-to-day expenses is never advised. With that said, new penny stock traders can get started with anywhere from $500 to $1,500.

Many traders with access to more money are encouraged to avoid making larger initial deposits.

The reason is simple: new traders need to establish an early habit of making great trading decisions and developing even better risk management techniques. Traders that focus on dollar amounts instead of percentage returns are more likely to fail.

For example, a new trader with a $500 account size is up a very realistic 25% on a penny stock trade. A disciplined trader would look at the percentage return, take the profit and pat themselves on the back for a job well done. After all, the vast majority of mutual funds can't duplicate this kind of return in a full year.

Traders that look at the $100 profit and aren't happy with the profit are looking at the position the wrong way. These traders could end up watching their $100 profit get cut in half and then maybe even transition to a loss.

What happens when a successful trader doubles their $500 account balance many times over? When they are playing with “big league” money of $20,000 it is almost a natural reaction to sell a 25% winner while undisciplined traders are unlikely to be satisfied.

Day trading penny stocks with a $500 account is a lesson in money management. The most important lessons are learned in the beginning and need to be mastered before attempting to make six-digit annual returns.

839GYLCCC1992

Leave a Reply