What is Leverage Trading and How to Use it Wisely

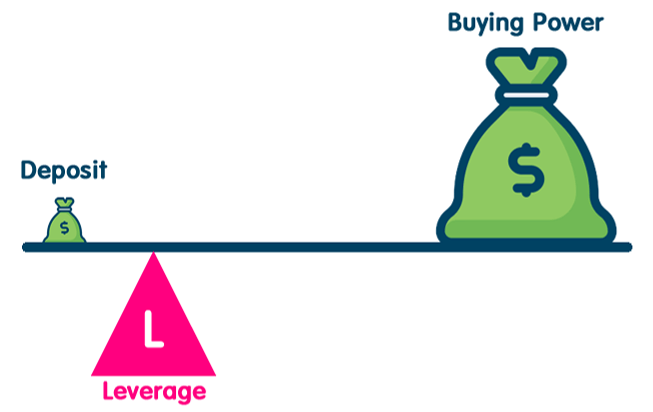

Regardless whether you are a new or experienced forex trader, one term you will come across very quickly in the industry is that of leverage. Leverage is essentially your increased buying power. Leverage is facilitated by margin. This margin is a loan which is extended to you from the broker in order to increase your buying power to make the trades you want. Leverage is offered by every forex broker website, and utilized in varying degrees by most of the traders in the industry.

Getting Started with Trading and Leverage

The foremost thing to do when you start to develop an interest in leverage trading in the forex market, is establish an account with a forex broker. TradeFW is widely respected and considered among the best forex brokers for beginners and experienced traders alike. They offer leverage trading up to 1:30 on major currency pairs, and many other markets.

As mentioned, leverage trading increases your buying power by the applicable ratio. In the above example, with an account balance of $10,000 leveraged at a ratio of 1:30, you would be able to engage in online forex currency trading of up to $300,000 value in that market. At the conclusion of your trade, you should then repay the amount borrowed on margin from the broker, in this case $290,000. This leaves you with the profit minus the interest and fees. If the market you are trading increased 10% for example, you would be left with $330,000. This represents a $30,000 profit prior to fees and interest. Without applying leverage, this profit would only be $1,000.

Factors to Consider When Leverage Trading

Leverage trading is of course widely utilized, and can be extremely beneficial when you spot an opportunity in a particular market and wish to take advantage of it. There are certainly risks though, and a few points to keep in mind before leveraging even through the best online currency broker.

Interest and fees are primary factors to consider. Your leverage is based on margin. This is a loan from the broker, and it is subject to fees and interest. You should carefully review this and other fees such as swap fees. It is good practice to review the forex trading rates of any broker prior to registration. This ensures you get the best possible deal.

The very large factor not to be overlooked when utilizing leverage, is risk. Naturally, this can work very well and profitably when the market is in your favor. In this case, profits can be greatly amplified. So too can losses though, and you should be extra vigilant to ensure you remain within your limitations.

This involves more than just registering an account with the best broker for trading. This means being proactive in calculating your own risk and positions against what you can afford to lose. General rules which can ensure you never slip too far behind in terms of risk with your leverage include, always trying to keep the levels as low as possible, setting trailing stop losses on the downside to help protect yourself, and ensuring you only use a maximum of 1-2% trading capital on each position.

Maximizing Your Trading Benefit

Many a forex trading blog can be found which will inform you of the benefits of leverage. Maximizing your trading benefit though is all about how you manage the leverage available to you. When applied in the correct situations it can greatly boost your bottom line as a trader. You should however, use caution not to over apply leverage to every trade. Identifying levels that are comfortable to you is the most important aspect of using leverage in a positive manner.

In order to reach the best results from your use of leverage, you should also ensure that you are operating through the best currency trading company who will provide you with top quality assistance in terms of customer service. This is a feature which you may need to avail of, particularly as amounts increase.

The final tip for maximizing the impact of your leverage, is take in all of the knowledge that you can. This relates to a particular trade and also the trading platform you are using. MT4 is commonly used throughout the industry, and has a range of features that can really assist you in making the correct leveraged trades if you know how to use them. This includes things like signal services.

Conclusion

Leveraged trading ca be a wonderful asset to your trading career, and really help to advance your position in forex trading .This is the reason why all of the best forex platforms offer extensive leverage. Once you have understood the best situations to apply, and limitations of leverage, you will be well placed to trade with a high degree of success.

839GYLCCC1992

Leave a Reply