Theories Behind the Pound Flash Crash

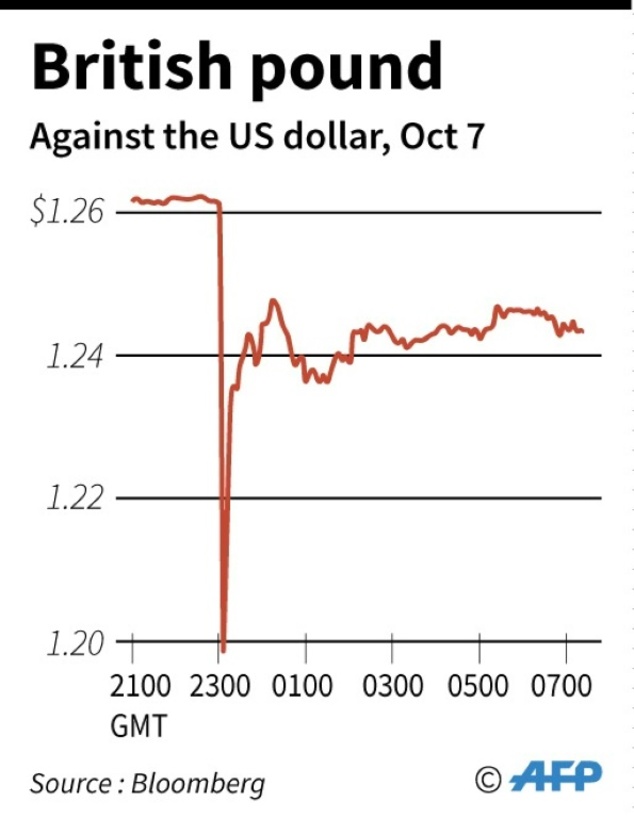

Sterling pound tripped lower in the forex market against its major counterparts in what investors’ term as “flash crash” in 31 years: hundreds of pips in less than three minutes. On the same note, the US Dollar also slipped in response to the unexpectedly lower job growth in the U.S in September.

According to technical analysis for one investment bank, the plunge of sterling affected a few crucial chart levels on the negative side and leaves it vulnerable over the next few months.

What Caused the Flash Crash?

The genuine reason for the sudden crush of sterling pound is not yet known because there was no economic report scheduled for release. So, financial analysts rushed to form theories as to what caused the flash crash event. Here are the key theories:

Illiquid Market

Some users of CMC Markets believed that the sudden fall was as a result of automated trading system, with the assumption that the computer was instructed to sell off the currency in response to the negative Brexit stories. In addition, New York just closed shops, London is asleep, Tokyo traders are yet to start trading and Singapore and Hong Kong’s markets are still not opened. It is exactly the most illiquid period for any regular forex period. In fact, it is believed that dealers failed to offer bids into their trading platform or more liquidity providers failed to load bids.

If you are a new trader out there, think of this situation as the sellers lowering their prices until they find buyers, anybody willing to match the price.

“Fat Finger” Incident

Some analysts believe that a trader accidentally entered a wrong number, while creating a trade order. Remember, this is not a common occurrence in the forex scene. Some traders say they failed to buy orders when the points went down and had to scramble to take the advantage of short positions, hence contributing to flash crash: roughly 500-points.

Algos

Some financial analysts on the market blamed it on the algos: the fastest robots that use algorithms to make large trade efficiently and swiftly. It is believed that algos could have taken the fat finger move and uses it on their subsequent orders, causing wild swings in the market. The algorithms trade is always based on news headlines and social media conversations, while retaining an aspect of normal human input.

Could the Pound Fall Further?

The GBP/US fell slightly over 30% in the last six months since the UK was forced to exit ERM2 in 1992 and further went down 36% in mid 2007-2009. Currently, GBP/USD is trading below 30% after the Brexit high. However, the story is far from over, because there is enough evidence confirming that the pound pressure will continue. It is not only the thin trading volume, low liquidity or fat finger that pressures the currency. The encouraging aspects of the U.S’s September payroll report, which indicated a steady 0.3% rise in wages and higher participation rate. This will limit the loss of dollars and support market expectations for the Federal Reserve, raising interest rates at the next policy meeting.

How Bad Was the Damage?

Even though the week currency might boost the exports in the UK, there is a lot of market fears and uncertainty. The pound went down to 1.1485 against U.S Dollar, a low not witnessed since 1985. EURO/GBP also hit the highest in seven years, 0.9359, before getting back to sub 0.9000 levels. On the other hand, GBP/JPY fell by more than 225 pips from its opening price before seeing a few buyers. Remember, these drops happened just in less than three minutes!

The uncertainty over the flash crash of the pound spooked Asian capital traders and provide them an advantage to make profit ahead the NFP release.

The Bottom Line

The most important thing about situations like this is that it provides traders with an opportunity to learn new things. Remember, trading during the initial stages of Asian session has illiquidity problems and this exposes traders into volatile price action. Besides, traders must accept that the presence of algos always creates volatile price action in the forex scene.

Unless traders are assured that Britain has better bargaining power over other EU members, then traders are likely to witness more fight from the UK assets in the next few months.

839GYLCCC1992

Leave a Reply