The Risky Experiment with Negative Interest Rates

In the past, negative nominal interest rates have always been regarded as a theoretical phenomenon. The general assumption used to be that there is a logical zero-bound for interest rates. Most people wouldn't consider it natural to be paid to borrow money. Recently, the ECB and other central banks have set deposit rates below 0% in an attempt to jump-start the economy. Some economists now fear that this could have the opposite effect.

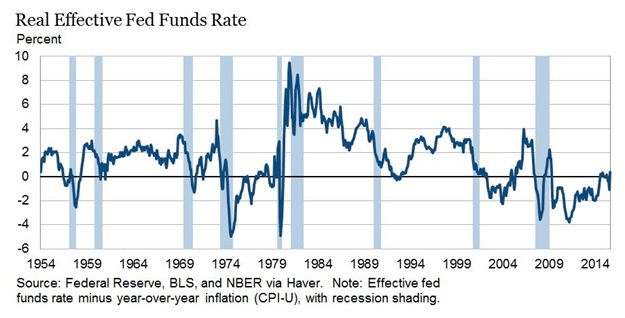

Negative real interest rates – the nominal interest rate minus the rate of inflation – aren't new. Central banks have often deliberately kept their refinancing rates below inflation to stimulate borrowing and hence investment in the real economy. What's new is that central banks are now setting key nominal rates below zero.

The ECB cutting the short-term deposit rate had an interesting ripple effect. Banks are now stuck with excess money and are looking for safe havens to invest in. On Wednesday, July 13th, the German government sold a ten-year bond, also known as the “Bund”, at a yield of minus 0.05%, making it the third country to do so after Switzerland and Japan.

The degree of uncertainty – especially concerning the EU economy – is currently so high that many institutional investors would rather lose a small amount of money than take any risk.

A New and Experimental Policy

In the past, negative real interest rates tended to appear in times of great uncertainty and recession. There are several historic events which impacted the economy to the extent that interest rates became negative for brief periods of time.

Examples of these are the oil shock in the early 1970's, the recession that hit the US after the Gulf War of 1990/91 or the Financial Crisis of 2008. In all of these case, the real interest rate became negative as a result of high inflation and a low Fed funds rate. Up until recently, no Central Bank has actually instated a negative nominal interest rate policy.

The Economic Ripple Effect and the Potential Risks

Economists consider negative interest rates a big risk. There are several ways in which they are likely to affect the economy and investors.

Pension funds and life insurance providers depend on safe assets with regular payments and are heavily invested in government bonds. If interest rates stay this low for longer periods of time, such funds' returns will shrivel, resulting in lower pension payments for investors.

Decreasing interest rates harm a currency's value. After the ECB set their deposit rate below 0% in 2014, the EUR began to tank compared to the USD, depreciating from 1.40 to 1.11.

A negative interest rate policy will certainly affect the global currency markets. Economists fear a race to the bottom in which more nations slash their interest rates into negative territory.

Aside from destabilising the foreign exchange markets, it is also likely that the low interest rates banks now pass onto their customers will incentivize people to keep cash instead of depositing their money in a bank. If this happens on a large scale, banks would lose and important source of funding.

The low yields of relatively safe assets are motivating investors to look elsewhere for returns. Many economists expect bubbles to occur in certain asset classes.

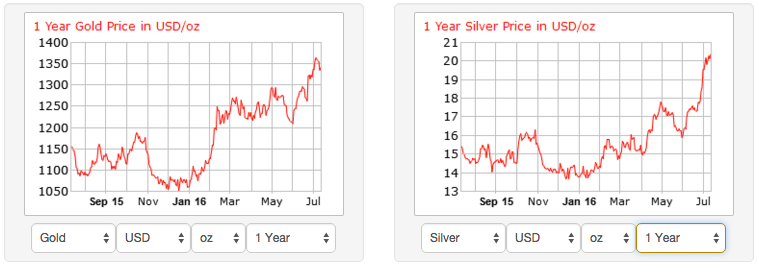

Crisis investments such as gold or silver have become very popular. The price of gold has appreciated by almost 25% since the beginning of 2016 and the price of silver by 45%. This trend is likely to continue.

Real estate is another popular safe haven for investors that are willing to tolerate a bit of risk. It remains an interesting investment in a negative interest rate environment and many analysts believe that right now is a good time to buy real-estate or related stocks and ETFs. Stocks remain volatile overall, but corporate bonds of blue chip companies are becoming more popular with investors seeking higher yields.

Some economists fear deflationary tendencies which could lead to a recession – the opposite of what central banks like the ECB are trying to achieve. If banks aren't willing to lend to the real economy despite punitive central bank deposit rates, negative interest rates could lead to continuing economic stagnation in combination with even more volatile markets.

In general, analysts regard the negative interest rate policy as somewhat of a risky experiment with an uncertain outcome. Investors should remain cautious as high volatility is likely to prevail in the markets throughout 2016.

839GYLCCC1992

Leave a Reply