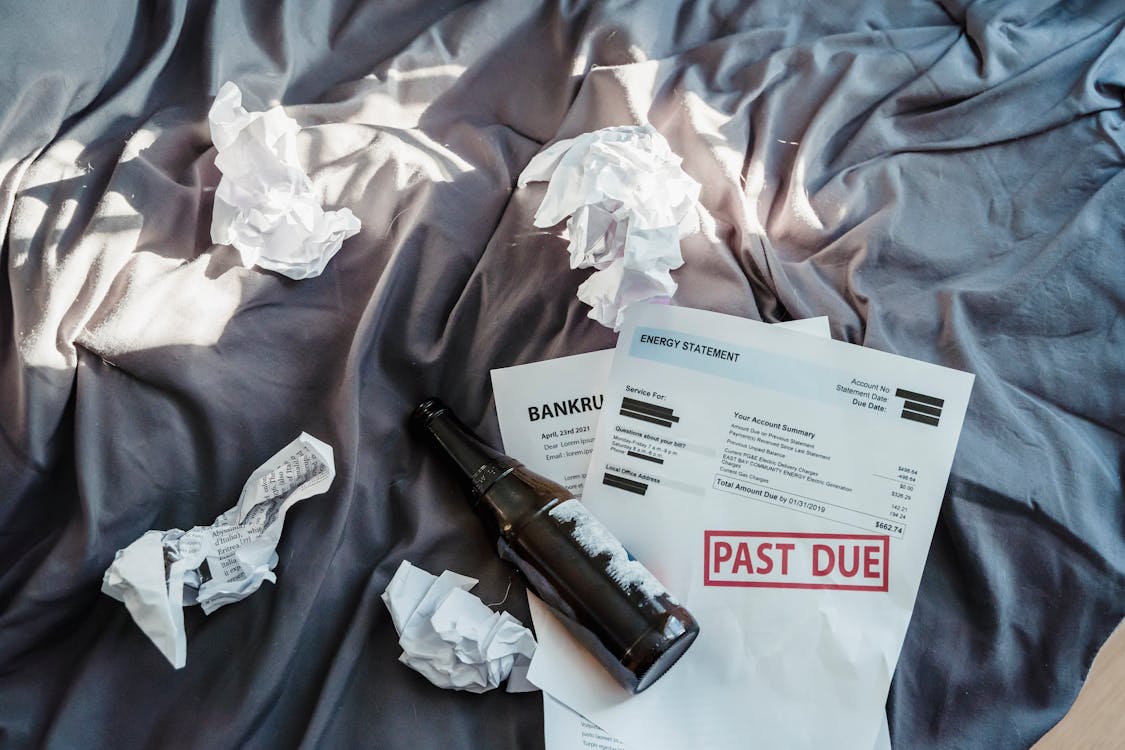

What To Do Before Declaring Yourself Bankrupt

It's a pretty harsh situation when you need to declare yourself bankrupt, though for those who need to do it, it can often prove to be a necessary and useful way out of whatever troubling times they are going through. If you are considering declaring bankruptcy, you will however want to make sure that it is definitely the right thing to be doing. After all, if it isn't, you're going to need to work out what is.

As it happens, there are a few things you can try first, before declaring bankruptcy, to ensure that you can probably avoid doing that at all. So if you have tried some of the following, you are a little more likely to avoid this situation, and to find yourself in a much better place financially. Let's take a look at what you might want to consider here first and foremost.

Check How It Will Affect You

First of all, you need to make sure that you are fully aware of exactly how a bankruptcy is likely to affect you. There are a few things to think about here, but it's important that you are aware of some of the major ways in which you can be affected here. One of the most important of these is how it will influence your financial situation with regards to your debts. For instance, not all of your debts will be affected or included, so going bankrupt does not necessarily mean that all of your debts are simply written off.

That, plus the fact that you may need to give up your home and other belongings, means that this is not a situation to take lightly. As long as you are aware of all that, and you know it's still your best possible decision, you can go ahead with it.

Boost Your Coffers

It could be that you can avoid bankruptcy altogether just by improving your finances first. There are a lot of ways you can do this, and anything that is going to effectively add money into your account is going to be well worth trying first. As it happens, once you start looking for ways to do this, you soon discover that there are many of them that you can consider and which might be beneficial for you.

For instance, have you checked that you don't have any payments coming in? You might have something like a structured settlement, meaning that you're probably expecting a few installments of that to come in at some point in the near future. But if you want to improve the situation you are in now, you could find a buyer for your settlement to give you a lump sum right now. You can learn more here about that, if that is something you think you might be able to do.

Alternatively, it could be that you are able to make some money in some other ways, so it's important to leave no stone unturned in trying to do this. Bankruptcy should always be a last resort.

Have Debts Written Off

It is often possible to have debts written off without being bankrupt, so it's a good idea to check whether you can do this with your own debts before you go down the bankruptcy route. This can be done in a number of ways. For instance, you may be able to simply appeal your debt through your creditor, and in so doing you might be able to have it written off that way. Or you might be able to consolidate the debts and so have more opportunity to pay it off over time.

In any case, this is something to aim for, because it will certainly be better than having to declare yourself bankrupt. In some cases, you might be able to get a holiday from a debt, depending on your situation. So it's important that you don't simply assume this is not possible – it may well be so.

Be Prepared Emotionally

You can probably see why this is something that would be emotionally difficult, so it's important that you are preparing yourself as well as possible for that. As long as you are ready for the emotional side of things, you're much more likely to experience the situation in a much less worrying way, and to get through it easily. This is something that is going to make a huge difference all in all, so make sure that you are doing this as best as you can.

839GYLCCC1992

Leave a Reply