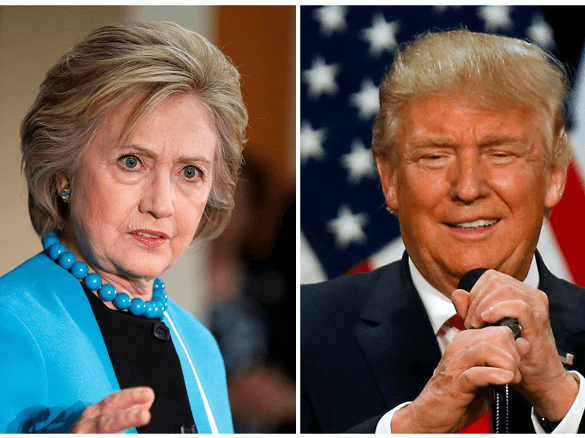

Clinton vs. Trump: Predicting the Impact of the U.S. Presidential Election on the Financial Markets

One issue that has been making headlines across the globe is the U.S. presidential election. America has been in a frenzy, thanks to controversial candidates, off-the-wall policies, and newsworthy and slightly eccentric statements that have sometimes seemed luridly out of place in our modern world.

These dramatics have people hooked, with debates pulling in the same audience numbers as professional football games. Everyone understands how high the stakes are; the outcome could shake the foundations of lives all across the globe.

With the future of one of the world’s largest economies soon to be rewritten by whichever candidate comes to power, the markets will undoubtedly react. So what could this mean for traders?

An Unpredictable Outcome

Experts like ETX Capital know exactly what an indeterminate electoral outcome means for the markets: prevailing uncertainty. Where the result of a presidential race is difficult to predict, uncertainty reigns, and this will always set investors on edge.

This is particularly pertinent with regards to the upcoming American election. As professional Mary Ann Bartels explains: “This time, we’ve got a lot of uncertainties. And if there’s one thing markets hate, it’s uncertainty.”

For the markets, this means that it could be a bumpy ride all the way through to November 2016.

A Power Vacuum

The first factor that we must isolate in order to properly examine the situation is the fact that President Obama is not up for re-election. Irrespective of their party or policies, those presidents who retire after two terms historically leave behind a power vacuum that the markets find unnerving.

If we look at historical precedents for such a scenario, the statistics are far from promising. Where a president is not seeking re-election, Standard and Poor’s 500 has traditionally dropped 2.8 per cent during election years. These statistics date back to 1928, lending a particular gravitas to the numbers.

In fact, the figures show that the only time in a two term presidential cycle when negative market returns are seen is usually the eighth and final year, when it is clear from the outset that re-election is not a possibility.

Conversely, returns for the years when a sitting president is up for re-election average 12.6 per cent.

Unknown Quantities

The difference this time around is that not only is the sitting president not up for re-election, but a number of presumed frontrunners fell out of the running early on. This has meant that the candidates that remain are arguably unknown quantities to some extent, particularly because of the lack of any previous political career in some instances.

As economic expert George L. Perry posits: “From the first days of the campaign, we had some prominent candidates who had no political experience, so we have very little basis to judge how well they would deal with Congress, with the Senate, and run the show.”

Even the individual candidate’s party affiliations provide little indication of how their policies would impact the markets, because, as Mr. Perry continues: “The general idea that the Republicans are the party of business and the Democrats are the party of labor is actually wide of the mark. If this was ever true, it hasn't been for a long time.”

His point is supported by irrefutable fact, for whilst the Dow Jones Industrial Average bloomed under the policies of Republicans Ronald Reagan and Dwight D. Eisenhower, Democrat presidents have presided over similar market surges, with Franklin Roosevelt and Bill Clinton providing perfect examples.

The Power of Economic Proposals

This doesn’t mean that investors must shoot entirely in the dark. The economic proposals of candidates should provide some idea of the potential policies that will be adopted, thus allowing you to apprehend the resultant market movements.

For example, U.S. corporate tax rates currently stand at 39 per cent, making them the highest in the developed world. It is likely that these will come up as a topic for debate, and that if a frontrunner makes a suggestion to reduce them, that this will catalyse bullish sentiment.

Further issues to look out for, according to Ms. Bartels, will be proposals to reform Medicare and Social Security, as well as regulatory relief for businesses.

Differentiating Statistics from Prophesy

One important point to note is that statistics are not a definite indicator of the future of the financial markets. Like the markets themselves, presidential races are influenced by a thousand different factors, and what happened once may never happen again.

In the same vein, the party who are elected, and the policies that they implement, may not affect the markets in the same way that they have before. All it takes is an unexpected military coup in a country thousands of miles away, or a devastating natural disaster closer to home, to turn them on their heads.

This means, of course, that the fallout from the election cannot yet be predicted with any level of certainty, and thus it is uncertainty alone that prevails in the instant.

However, if history is anything to go by, then the likely downturn presaged by the election is unlikely to endure past 2017, when America will probably experience a ‘relief rally'. On average, this causes the markets to grow by around 6 per cent during the first year of a new presidential term; a little below the 7.5 per cent average for all years, but a positive upturn nonetheless.

Looking to the Long-Term

Throughout the remainder of 2016, we can say little except this: the markets are likely to be volatile. Yet this does not have to derail your strategy. The fallout is inevitable, so rather than worrying about it, it is often better to take some time and focus on your personal goals, and the broader economic trends influencing American and global markets.

This is a view that Mr. Perry agrees with. In his words: “The real message is that the stock market is a great place for people to put their money for the long run – and I would emphasize: for the long run.”

Ms. Bartel goes even further, elucidating some of these external forces: “There are massive, long-term trends that will generate opportunities – and, in some cases, challenges – no matter what happens politically. To name just a couple: the digital era, big data, cloud computing, and cybersecurity will continue to change the world. And the baby boom generation alone represents a $15 trillion economy, generating demand for everything from health care to leisure to hospitality. These underpinnings of the economy are not going to change, whoever ends up winning the White House.”

In our view, the best course of action presents itself thus: dig in for the long-term, and be prepared to weather the storm in the instant.

839GYLCCC1992

(2 votes, average: 4.50 out of 5)

(2 votes, average: 4.50 out of 5)

Leave a Reply