The Bull Run Continues – What Stocks to Watch in December?

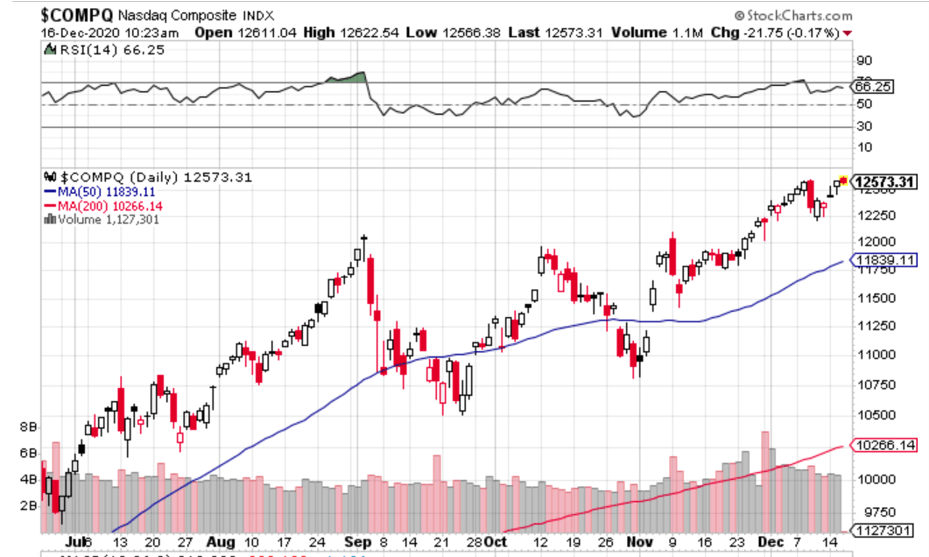

Source: StockCharts NASDAQ Composite Index

Source: StockCharts NASDAQ Composite IndexThe 1-year performance (December 16, 2019 – December 16, 2020) of US indices belies the angst, pain, and suffering that global markets have endured since the outbreak of the novel coronavirus. Massive and unprecedented shutdowns, lockdowns, and slowdowns have hit worldwide markets with Cat 5 hurricane force, yet US markets remain resilient. The NYSE Composite Index is up 4.43%, The Dow Jones Industrial Average is up 6.92%, the S&P 500 index is up 15.87%, and the NASDAQ composite index is up an incredible 42.70%.

Given this resilience and bullishness, one would be remiss to assume that the stock market doesn't have viable offerings up for grabs. The fundamentals of the US economy are sound, what with a buy USA policy in place, lower corporate taxation, revised trade agreements with Mexico and Canada (USMCA), hard-hitting tariffs on China, and massive and unprecedented economic stimuli about to make their way into businesses and households across the United States, once again.

It was recently announced that Senate leaders and House leaders are getting closer to passing a $900 billion Aid Package, JIT for the festive season. Senator Bernie Sanders of Vermont was hoping for a stimulus check of $1200 + per person, but that has been roundly rejected and lesser payments will likely be made to individuals.

What Stocks Are Looking Promising in December?

Stock trading experts from the leading brokerages and trading platforms routinely advise caution whenever selecting stocks for trading or investment purposes. Careful and methodical analysis of the technical and fundamental elements of a stock is necessary before any trading activity is undertaken. When the pandemic hit, businesses and individuals – uncertain how to deal with the pandemic – instantly retreated, fearing restaurants, hotels, cruise ships, shopping malls, supermarkets, schools, and SMBs where people congregate. As time has passed, mask mandates, limited numbers, lockdowns, treatments and vaccines have altered the collective mindset.

While coronavirus has resulted in an estimated 1.65 million deaths worldwide, with tens of millions of people infected, there is a renewed sense of hope that the world will be coming to grips with this pandemic, as Pfizer, Moderna, and other pharmaceutical companies around the world roll out vaccines en masse. As testament to the renewed sense of confidence, the MSCI world index of global stocks has improved by 10% – a substantial margin, given the cataclysm which we have agonized through. Plus, the global GDP tracker is currently at 3.7%. It is against this backdrop of renewed hope and the promise of a better 2021 that analysts are carefully eyeing the best stocks to watch for trading and investment purposes:

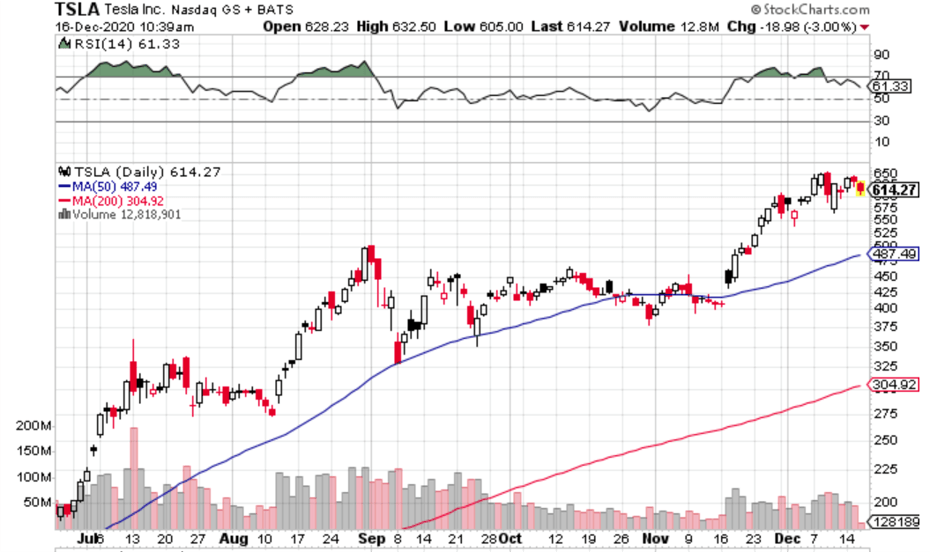

Tesla Incorporated – NASDAQ: TSLA

Source: StockCharts Tesla Inc

Source: StockCharts Tesla IncTesla, the electric vehicle manufacturer headed by genius entrepreneur and inventor, Elon Musk, has had a fabulous run of form. The stock’s price trajectory is strongly bullish, as evidenced by surging prices from left to right in the chart above. The Bollinger Bands, (20, 2) for TSLA stock indicate a low band of 484.13, a center band of 582.39, and a top band of 680.66. These numbers are telling, since the prevailing price of Tesla stock is well beneath the top band, indicating further price appreciation is possible before the end of the month. This bodes well for Tesla stock options for trading or investment purposes with a short-term price arising. Of course, like any NASDAQ stock, volatility is the order of the day.

The price of Tesla stock plummeted midway through December, indicating just how much of a dice roll tech stocks can be. However, the stock has beaten earnings expectations in multiple successive quarters, including Q4 2019, Q1 2020, Q2 2020, and Q3 2020. Revenues have increased strongly in that time, but earnings remain anemic. In terms of recommendation ratings, Tesla currently sits at 2.8, between a buy and a hold. Short-term, there is speculation that Tesla's stock price could drop once it enters the S&P 500 index. Many analysts believe that it is heavily overvalued, and that the stock's price should be in the $60 – $80 range. If government-sponsored electric vehicle credits are pulled from Tesla, the company's valuation will be cut down to size.

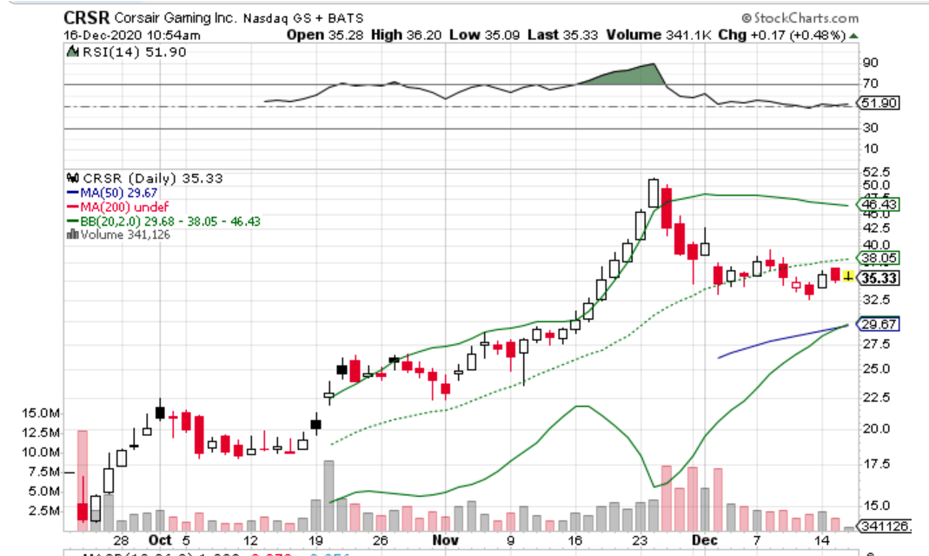

Corsair Gaming Inc – NASDAQ: CRSR

Source: StockCharts Corsair Gaming Inc

Source: StockCharts Corsair Gaming IncCorsair Gaming Incorporated (CRSR) is currently trading around $35. The stock has had a spectacular run of form since September, appreciating almost 100% in that time. With a 50-day moving average of $29.67, and an undefined 200-day moving average, the stock has certainly added plenty to traders portfolios. The Bollinger Bands (20,2) provide additional technical insights for the stock. For example, the lower Bollinger Band is priced at 29.68, the center band is at 38.05, and the upper band is at 46.43. This indicates that the current price is beneath the center band and that the stock is likely undervalued, with strong upside potential remaining.

From an analyst perspective over the short-term, it is clear that bearish activity is pervasive. Yet, the stock is still deemed overvalued. In Q3 2020, the stock beat earnings expectations in a big way, outpacing estimates and racking up a strong recommendation rating between 1 (strong buy), and 2 (buy), at a figure of 1.8. Analyst price targets have averaged this stock’s expected price in the region of $40.11 at a $5 premium above the spot price. Recently, Cowen & Co downgraded the stock from outperform to market perform, and there has been a degree of consolidation around the $35 price range. From a futures trading perspective, CSCR has enjoyed a net increase in the number of long options. This bodes well for a higher price moving forward.

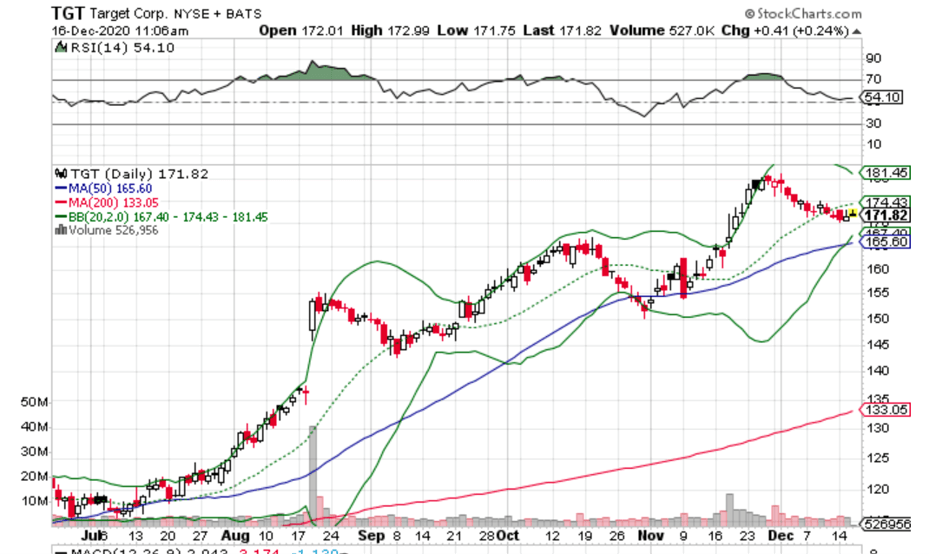

Target Corporation – NYSE: TGT

Source: StockCharts Target Corporation TGT

Source: StockCharts Target Corporation TGTTarget Corporation stock is currently trading around $172. For the year-to-date, Target has performed incredibly well from a starting base of $126 to its current price. The $46 appreciation represents a 37% return on investment based on January 1, 2020 figures. For November and December 2020, Target Corporation (TGT) stock enjoyed a brief run up in prices, followed by a gradual tapering off and consolidation.

Based on the current patterns, TGT is deemed bearish, with a negative performance outlook over the short-term and mid-term. However, the long-term performance outlook is bullish. In terms of earnings versus expectations, TGT stock has outperformed. In Q1 2020 it posted an earnings beat, followed by earnings beats in Q2 2020, Q3 2020, and Q4 2020. The consensus recommendation rating for TGT is 2.1, on a scale where 1 represents a strong buy and 5 represents a sell.

It is imperative that due diligence is performed whenever anyone recommends stocks for trading or investing purposes. The market is a convoluted agglomeration of cause and effect, comprised of related and unrelated factors.

839GYLCCC1992

Leave a Reply